Picture: A close up Photograph of somebody's palms utilizing calculator although dealing with charges and home funds.

Lastly, Patelco offers various own loan sorts that might attract borrowers with poor credit score. Together with an unsecured personalized loan, you can choose from a secured credit history builder loan, a secured discounts loan, and other secured lending possibilities.

Present day home finance loan rates30 yr mortgage rates5-year ARM rates3-calendar year ARM ratesFHA home loan ratesVA mortgage ratesBest property finance loan lenders

Some sorts of unexpected emergency loans can have an impact on your credit history score, while others won't. If a lender doesn’t report your account to one of many a few important credit bureaus, the loan won’t influence your credit rating rating—Unless of course you default and a set company adds the bad debt to your credit history stories at a later day.

We also reference authentic study from other dependable publishers where by correct. You'll be able to learn more concerning the criteria we observe in making exact, impartial articles in our editorial coverage.

If you've got terrible credit history, This can be the worst time for you to get a personal loan, considering that your weak credit history will limit your decisions and set you back far more money in expenses and interest. That said, in case you are in a decent place, you might not have enough time to attend, and an emergency loan might be your very best choice. It can be less costly than possibilities just like a payday loan or charge card dollars advance.

When you don’t shell out your balance in whole in the course of the advertising period of time, you’ll be about the hook for deferred interest. Meaning interest will backdate into the day you built the charge.

Our best picks are rated A or higher by the BBB. Know that a large BBB rating isn't money loan asap going to be certain a good romantic relationship using a lender, and you should keep researching and speak with Other people who may have applied the company to get the most entire info achievable.

Why Personify stands out: Personify is a web-based lender which offers various personal loan amounts and conditions, based upon where you live.

Your very first payment will likely be due about 30 times after you’ve obtained your loan. Consider signing up for autopay to ensure you remain on course. Some lenders (including LightStream and SoFi) provides you with an APR lower price for doing this, way too.

Why Affirm stands out: If you must borrow money for just a retail obtain, Affirm may be a fantastic different into a bank card. The organization partners with Many online shops and shops — from home furniture stores to auto components suppliers — to supply own loans for purchases.

Refinancing and fairness guideToday's refinance ratesBest refinance lenders30-calendar year fixed refinance rates15-year set refinance ratesBest income-out refinance lendersBest HELOC Lenders

Each individual classification's weighting is predicated on its value to the borrowing practical experience. Prices and fees have by far the most direct influence on the overall Price within your loan, so we weigh Those people probably the most seriously.

Don't just are these sorts of loans extremely high-priced, but you would possibly turn out acquiring trapped in the payday borrowing cycle that’s hard to escape.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Tina Majorino Then & Now!

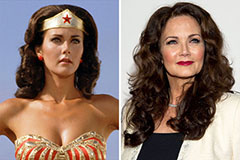

Tina Majorino Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!